Proudly helping businesses since 2012

Capital E Bookkeeping provides bookkeeping and BAS services to small & medium businesses across Australia.

Your Capital.

Your Business.

Your Success.

A selection of our happy client reviews...

Thank you for making sense out of what used to be a point of stress.

They're reliable, organized, and consistently accurate with the work they do. I was feeling overwhelmed with the financial side of my business but after a meeting with Elizabeth a huge weight was lifted of my shoulders! Cannot recommend Capital E Bookkeeping enough!

Communication is always clear and timely, and they’re great at explaining things when I have questions. It’s made managing the financial side of my business less stressful and smoother

Highly recommend to anyone looking for a professional, top quality bookkeeping services.

Thankyou!

I highly recommend her and the company. You won't be disappointed.

Lu

I called Elizabeth on the off-chance that she might be able to assist with a thorny accounting issue I was having. Not only did she go to the ends of the earth to find a solution (that satisfied both my software and the ATO), but she walked me through implementing the process at my end in a way that was easy to understand and continue with. Her knowledge and ability to think laterally about the problem and how it could be solved across our accounting software, inventory management and POS was remarkable and I feel so fortunate to have found her. To this point I had been reticent to hand over our bookkeeping to an external party, however thanks to Elizabeth’s warmth, enthusiasm and expertise I am now feed up to work on other aspects of our business.

Services

Whether you’re a start up or an established business, we listen to all your requirements and work together as a team to identify and improve your bookkeeping systems and processes.

We have an extensive skill set, knowledge and competency within the Industry to provide you with high quality Bookkeeping and our expertise BAS Services.

You will be able to meet your compliance requirements, understand your business performance, manage your cashflow, and make informed decisions that will help you achieve your business results.

We can tailor our services according to your business needs and also offer fixed price packages that will work for you.

We are organised, responsive & committed to helping you achieve your business goals

Xero Set-up & Bookkeeping

After our initial consultations, we schedule a time with you to set up your Xero file with access to our Platinum partner discount rates.

We cover items including:

- Organisation details

- Financial details; cash or accrual

- Chart of accounts

- Tax codes

- Invoice templates

- Bank feeds

- Payroll settings

- Hubdoc

- Stripe

- GoCardless

- Tap To Pay

- ATO Agent Linking

Bookkeeping & BAS

- Professional, friendly & dedicated Bookkeeper for every client

- Flexible, tailored services

- Up to date with Australian Tax & GST legislation

- Experience in dealing with confidential data

- Bookkeeping reconciliations

- IAS/BAS preparation and lodgement – Monthly & Quarterly

- FTC Fuel Tax Credits

- TPAR Taxable payments annual reports

- Profit and Loss & Balance sheet reporting

- Invoicing

- Accounts payable

- Accounts receivable

Payroll

- STP Single Touch Payroll and processing

- AutoSuper payments

- Annual Workcover account management

- Annual Payroll Tax management

- EOFY STP single touch payroll reconciliation and finalisation

About Capital E Bookkeeping

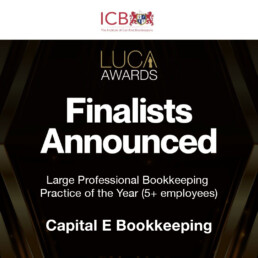

Capital E Bookkeeping are accredited BAS agents and Xero Certified Advisers offering bookkeeping and BAS services to businesses across Australia.

Specialising in industries such as Construction, IT Services, Professional Services, Recruitment, Medical / Health, Fitness and many more.

As members of the Tax Practitioners Board, Institute of Certified Bookkeepers and Xero Platinum Partners, we ensure that we’re always kept up to date with legislation changes, provide accurate advice and access member discounts on new Xero files. Implementation of automated and simplified bookkeeping enables accurate data at hand, assisting business owners in making better and faster decisions while maintaining their compliance and reporting obligations.

We collaborate with Accounting practices across Australia and together, provide quality and efficient services to our clients.

Meet the Capital E Bookkeeping Team

Meet our dedicated team, committed to helping you

Elizabeth Nikias

Director & BAS Agent

o Elizabeth founded Capital E in 2012, she’s an Accredited BAS Agent by the Tax Practitioners Board, a member of the ICB Institute of Certified Bookkeepers and also holds a Diploma in Business Management. She has extensive years of experience in the industry, is professional & trustworthy and has a passion for helping people with their businesses.

Cassandra McAllister

BAS Agent

Cas McAllister is a Registered BAS Agent, Certified Bookkeeper, holds a Cert IV in Accounting & Bookkeeping & a Diploma of Business Management. She loves supporting clients using lessons she has learned over the past 3 decades. Cas has worked in industries such as emergency services, motor industry and local government.

Maria Kiseleva

Bookkeeper

Maria is passionate about her work and brings genuine care to every client. She holds a Certificate IV in Accounting & Bookkeeping and is completing her Diploma in Accounting. With a strong interest in payroll and compliance, Maria keeps financial records accurate and organised.

FAQ's

Frequently Asked Questions

Some key information to help you understand Capital E Bookkeeping a little better, as well as how we can help your business.

A Bookkeeper helps you keep track of your business’s day-to-day financial transactions, like recording sales, paying bills, and balancing accounts. They make sure all your financial records are accurate and up to date. They focus on the regular transactions such as;

- Recording transactions in the software

- Accounts Payable and Receivable; Keeping track of what the business owes to suppliers and what customers owe the business

- Bank Reconciliations comparing bank statements with transactions in the software to ensure accuracy.

- Processing payroll.

- Maintaining general ledger; ensuring that the ledger is accurate and up to date

- Expense tracking

- Basic reporting of Profit & Loss balance sheet

A BAS Agent is a professional who is authorised to prepare and lodge business activity statements (BAS) and other tax-related services on behalf of businesses, including any other reporting obligations under the Australian Taxation Office (ATO) legislation.

A BAS Agent is issued a licence (registration) that says they can advise a client, and provide certainty to a client or represent that client to the ATO in relation to:

- All Goods and Services Tax (GST) matters (collected or paid).

- Wine Equalisation Tax (WET).

- Fuel Tax Credits (FTC).

- Luxury Car Tax (LCT) matters.

- Fringe Benefits Tax (FBT) – collection and recovery only.

- All aspects of payroll that relate to the withholding of tax amounts and the reporting of those amounts to the employee and the ATO.

- Services under the Superannuation Guarantee (Administration) Act 1992 to the extent that they relate to payroll functions or payments to contractors, including determining and reporting Superannuation Guarantee (SG) Charge (SGC) shortfall amount and any associated administrative fees.

- All aspects of completing and lodging the Taxable Payments Annual Report (TPAR) to the ATO, on behalf of a client.

- All aspects of other Pay as you go (PAYG) withholding (PAYGW) amounts; e.g. no Australian Business Number (ABN), interest and dividend.

- All aspects of the payment of income tax via PAYG instalments (PAYGI).

- Applications to the Register for an ABN, on behalf of a client.

In addition, a registered BAS Agent may:

- Design and set up compliance systems in respect to business and the BAS provisions.

- Advise a business on how the above areas of law affect them with respect to business and the BAS provisions.

- Review a business operation in relation to these areas of law.

- Review reports to verify their accuracy for the correct application of BAS provisions (GST, WET, LCT, FTC, PAYGW, SG, TPAR and the payment of PAYGI and the payment of FBT instalments).

- Provide certainty to the client that they are getting it right.

Note: These tasks cannot be done by a Bookkeeper who is not a registered agent.

An ABN registered business must register for GST:

- when your business or enterprise has a GST turnover (gross income from all businesses) of $75,000 or more (the GST threshold)

- when you start a new business and expect your turnover to reach the GST threshold (or more) in the first year of operation

- if you’re already in business and have reached the GST threshold

- if your non-profit organisation has a GST turnover of $150,000 per year or more

- when you provide taxi or limousine travel for passengers (including ride-sourcing) regardless of your GST turnover – this applies to both owner-drivers and if you lease or rent a taxi

- if you want to claim fuel tax credits for your business or enterprise.

As Accredited BAS Agents, we can apply for you once we have completed the ATO Agent Linking process.

The ATO introduced a mandatory process for business clients to follow when appointing a new BAS or TAX Agent or expanding access to tax agent services. The change applied from 13 November 2023.

This client-to-agent linking process aims to ensure that a client has control over which authorised BAS or TAX Agent or payroll service provider can link their account and gain access to their tax and superannuation affairs.

There are two accounting methods for GST – goods and services tax, a cash basis and a non-cash (accruals) basis. The method used will determine when GST is reported.

Businesses with an aggregated turnover of less than $10 million, or who use cash accounting for income tax, can use either method.

Most larger businesses must use the accruals method.

Cash Reporting

This means that GST is accounted for on sales and purchases in the reporting period in which payment is made and received.

The advantages of cash reporting method are:

- The money flowing through the business is better aligned with the activity statement liabilities, therefore easier to manage cashflow.

- Suitable for smaller businesses that handle cash transactions.

- Cash reporting is generally available to businesses with a turnover of less than $10 million, however the cash accounting method can be used if any of the following applies:

- A small business entity (individual, partnership, trust or company) with an aggregated turnover of less than $10 million.

- Not carrying on a business, but an enterprise’s GST turnover is $2 million or less.

- Income tax is accounted for on a cash basis.

- Running a kind of enterprise that the ATO has agreed can account for GST on a cash basis regardless of turnover, that is:

- A government school.

- An endorsed charitable institution or trustee of an endorsed charitable fund.

- A gift-deductible entity (unless it operates a fund, authority or institution that can receive tax-deductible gifts or contributions).

Note: Small businesses can choose to use either the cash method or the accruals method.

Some businesses may report on accrual for income tax purposes, however, choose to report on cash for GST reporting. This is quite common.

Accrual Reporting

This means that businesses recognise income as soon as they raise an invoice for a customer/client. And when a bill comes in, it’s recognised as an expense even if payment won’t be made for another 30 days.

If the business turnover is greater than $10 million it must use accrual reporting. A business may choose to use accrual reporting though if turnover is less than $10 million.

Accrual reporting is better suited to businesses that are not paid immediately and:

Tracks the true financial position of the business – what is owed and what the business owes.

Is more suitable when the business has multiple contracts and transacts large amounts of money.

A bank feed is a feature provided by financial institutions that allows transaction data to be automatically imported from your eligible bank accounts into your accounting software. We take care of all the bank feed set up with working on your Xero file.

Single Touch Payroll (STP) is an Australian Government initiative to streamline employers’ reporting to government agencies.

With STP you report employees’ payroll information to the ATO each time you pay them through STP-enabled software. Payroll information includes:

- salaries and wages

- pay as you go (PAYG) withholding

- superannuation liability information.

If you are new to employing, you will need to start reporting now through STP Phase 2 enabled software as soon as you start paying your employees to avoid any penalties. We can assist you with this enrolment when setting up your Xero software.

Auto super is a feature in Xero that allows you to send your employees’ super contributions to their nominated funds electronically. To register for auto super, you need to have payroll admin access and your organisation needs to be on a Premium, Comprehensive, or Ultimate pricing plan. When registering for auto super, you must nominate an authoriser to approve the superannuation payments. The authoriser must be an existing user with payroll admin access, and it is recommended to enter an Australian mobile number for the authoriser to ensure they can approve the payments successfully. This is generally us as your nominated BAS Agents and payroll processors.

From 1 July 2026, employers will be required to pay their employees’ super at the same time as their salary and wages

Taxable Payments Annual Reports (TPAR) are reports submitted to the ATO on contractors for providing services. Industries currently required to report TPAR are listed below.

Contractors can include subcontractors, consultants, and independent contractors. They can be operating as sole traders (individuals), companies, partnerships, or trusts.

The ATO uses this information to identify contractors who have not met their tax obligations.

TPAR must be reported to the Australian Taxation Office (ATO) by 28th August each year.

TPAR currently applies to the following industries:

- Building and Construction.

- Courier Services.

- Cleaning Services.

- Road Freight.

- IT Services.

- Security, Investigation and Surveillance.

- Government Grants.

Fuel Tax Credits (FTC) provide businesses with a credit for the fuel tax (excise or customs duty) that’s included in the price of fuel you used for business activities in:

- Machinery.

- Plant.

- Equipment.

- Heavy vehicles.

- Light vehicles travelling off public roads or on private roads.

To make a claim for FTC the business must be registered for both:

- GST when the fuel was acquired.

- FTC when the claim is lodged.

The FTC eligibility tool will assist with determining if the business is eligible to claim FTC for fuel acquired and used in the business.

Eligibility depends on the business activities and the kind of fuel used. Some businesses that are likely to be eligible are:

- Agriculture

- Construction

- Electricity generation

- Fishing

- Forestry

- Landscaping

- Manufacturing

- Mining

- Road Transport

When we set your Xero file, we integrate your free Hubdoc software.

Hubdoc is a data capture tool which extracts key data from documents, then creates transactions in Xero. You can:

- Email bills and receipts straight into your Hubdoc organisation

- Use the mobile app to upload a photo

As soon as Hubdoc receives a document, it extracts the key data such as contact, date and amount. When you publish the document, Xero creates the invoice, bill, credit note, or spend money transaction with a copy of the document attached.

You can set up Hubdoc to automate every step, so all you need to do is reconcile the transaction against your bank statement line in Xero. This is particularly useful if you get regular bills from the same supplier.

Hubdoc also stores documents so you don’t need to keep paper copies of bills and receipts. You can organise the documents in Hubdoc using tags and folders, or send them to another cloud storage system your business might use, such as BILL or Dropbox.

A director ID is a unique identifier given to a director who has verified their identity with the ATO. This will help to prevent the use of false or fraudulent director identities.

Regulators will be helped to trace directors’ relationships with companies over time and better identify director involvement in unlawful activity. The new system will help overcome issues with data integrity, which have always been a constant battle in regulating phoenixing and the illegal activities around this dilemma. This compliance regulator will further support small businesses by keeping out operators that are breaking the law.